Reaganomics, a success story (3)

During the Reagan Presidency (1980-1988) an economic revolution has unfolded. An unprecedented welfare expansion took place with the creation of 18 million new jobs. The understanding of the mechanism behind this economic miracle is important, because it can offer some tools to revive the economies in countries with overregulation and big governments. Willy De Wit, a member of the independent Flemish think tank WorkForAll, is an expert in Reaganomics. In this third part of our series on Reaganomics (see part 1 and part 2), he focuses on the Belgian economy and on fiscal issues.

Willy De Wit: "Belgian politicians apparently have no knowledge about supply-side economics. Universities are still teaching the theory of Keynes and the economic establishment does not seem to understand Reaganomics nor supply-side economics. Hence it is not surprising that Belgium has one of the heaviest levels of taxation in the world, a high unemployment rate and an increasing number of companies that are leaving the country. The media are still praising Keynes. Paul D’Hoore, the economics advisor of the Flemish public television service VRT is an admiror of Keynes. His book “De 100 kapitale vragen van Paul D’Hoore over mensen en geld” (100 capital questions on people and money) is mainly about micro-economics. The few lines on macroeconomics are completely in line with Keynesian thinking. Meanwhile the economic time-bomb is ticking for Belgium: high unemployment figures, an ageing population and the pension problem, the brain drain and an unbearable tax burden".

Willy De Wit has a six point blueprint for the Belgian economy, based on Reaganomics. "My program can create 600.000 jobs", he claims.

- A gradual but considerable cut of the highest marginal tax rates to 28%.

- The complete abolition of corporate taxes, with a repeal of all subsidies to corporations.

- The abolition of taxes on dividends. Investment and risk taking has to be encouraged, not punished. A reduction (or abolition) of tax rates can make investment opportunities profitable that formerly were not.

- The abolition of all agricultural subsidies. At this moment 45% of the total EU budget goes to agricultural subsidies, respresenting the huge amount of 45 billion euro per year. This is not only dramatic for the tax payers, but it is also very harmful for the developing world, mainly for the poor countries in Africa. As a consequence of the subsidies, European agricultural products are dumped (at prices far below the cost) on the markets of these countries, preventing them from competing with their own products on the world markets. To pacify our conscience for this scandalous behaviour, policy makers have created a government department for foreign aid. Allegedly, this is a compensation for the money we stole from the poor countries through agricultural subsidies for our own products. The tax payer has to pay twice: first for the subsidies and then for the foreign aid. It is a shame that Europe is pumping such huge amounts into agriculture, a sector we hardly need.

- A shrinking of the size of government. One out of four Belgians are working for the government. According to an analysis of the independent Flemish think tank Workforall the total cost of government in Belgium could be reduced by 50%.

- Abolition of the transfers of tax money from Flanders to Wallonia. About 10 billion euro is transferred each year from the Flemish tax payers to the French speaking part of Belgium. The reason invoked for these transfers is that Wallonia has an unemployment rate of 18% compared with 8% for Flanders. But the socialist political parties and the unions in Wallonia refuse to take structural measures to reinvogorate their economy. So long as Flanders continues to pay the unemployment benefits for Wallonia the latter have no stimulus to do so. A solution could be the splitup of Belgium in two parts. In a recent study, "The Size of Nations", professors Alesina and Spolaore demonstrate that it is easier for small countries to become rich than for large countries. Of the ten richest countries in the world (in terms of GDP), only four have more than 1 million inhabitants, and only one (the US) has more than 10 million. Flanders, Wallonia and Brussels could prosper more as separate states or as a confederation, compared to the present situation in a united Belgium.

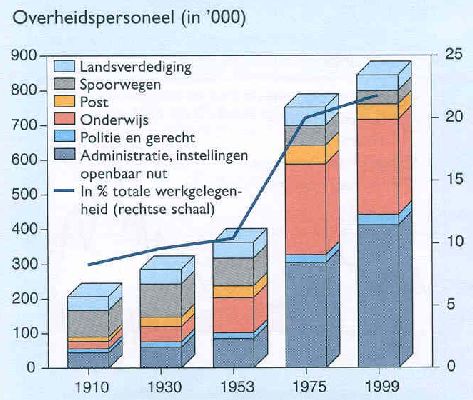

Evolution of government employment in Belgium - source: KBC & WorkForAll. From top to bottom: defense, railways, postal service, education, police and justice, administration.

DEFENSE SPENDING

I asked Willy De Wit the following question. Public spending increased during the Reagan era, mainly due to the growth of defense expenditures. The Soviet Union could not keep up with the arms race and its economy was slowing down. Within three years after the end of the Reagan Presidency, we saw the iron curtain fall and the Soviet Union collapse. Was this military buildup a Keynesian measure, a disguised subsidy to the defense industry? Surely this defense spending was not a supply-side stimulus, because it created an artificial demand for military equipment?

Willy De Wit: You are completely right. Defense spending is a typical Keynesian demand-side policy and is certainly not a supply-side approach. Supply-side economics has nothing to do with expenses, but with the creation of incentives to produce, to take risk, to work, to invest and to save. Reagan saw the increase of defense expenditures as a necessary evil, to safeguard the security of the US in the long term. Without this defense buildup (which was the main cause of the increase in public spending) government outlays would have been considerably lower, and the success of Reaganomics would have been even more pronounced. Indeed, supply-side economics have taught us that an increase in government spending does not boost economic growth. On the contrary, recent studies have clearly shown that there is an inverse relation between economic growth and the level of public spending. This means that the increase of the defense expenditures during the Reagan era has lowered economic growth. Money invested in defense was lost for more productive investments in the private sector. Anyway, we must keep in mind that the Reagan budget deficit was not caused by the tax cuts, but by the increase in spending (mainly for defense), and paradoxically by an increase in social outlays, i.e. 2.9% per year during the first four years of the Reagan Presidency. That is an indication that Reagan was not an anti-social president.

SUPPLY-SIDE ECONOMICS AND THE LAFFER CURVE

WHAT ABOUT A FLAT TAX?

An even better solution than the above sixpoint program, would be the introduction of a flat tax rate, not only in Belgium, but also in the (original) 15 EU countries. The flat tax is a system with only one tax rate for all income and profits. If for instance a flat tax of 20% were introduced it would apply on all personal income and on corporate profits. All reliefs, deductions, allowances and subsidies will be eliminated. Loopholes would be impossible. The system would be so simple that it will perhaps take no more than five minutes to file a tax return. In the last decade, the flat tax system has been introduced in several countries of "the new Europe", namely Romany, Slovakia, Servia, Lethuania, Latvia, Estonia and also in Russia, Ukraine an Georgia at rates varying from 12% till 33% (average rate of 19%). Estonia was the first to introduce this system in 1994 (at a rate of 26 %) and has seen his economy expanding at a fast rate.

A low level of a flat tax is important. The well-known Richard K. Armey, previous Majority Leader of the House of Representatives advocates a tariff for the US of maximum 17%. But this rate could even be lower. An analysis by the French economist Philippe Manière indicates that a flat tax rate of 10% in France would maintain the government revenues at the present level.

For Belgium, the introduction of a flat tax rate of maximum 20% would have enormous advantages a.o. :

- The economic growth rate will explode. Indeed a strong incentive is created to produce, to take risk, to work, to invest and to save.

- Unemployment will disappear completely.

- Tax Evasion will belong to the past. People are willing to pay the correct tax burden when tax rates are low.

- An important part of a suffocating government bureaucracy can be eliminated and this people can be switched to more productive tasks.

CONCLUSION

Will Reaganomics or supply-side economics ever be applied in Belgium? In the UK, Ireland, Iceland and Eastern Europe current economic policy has strong supply-side influences. Currently Germany is in a worse socio-economic situation than Belgium. Who knows, some day Germany might return to the successful formula of Ludwig Erhard and create a new Wirtschaftswunder, by applying supply-side economics. Such an example could show the way to Belgium and other countries.

MORE READING ON REAGANOMICS

"Reagonomics or 'voodoo economics'?", BBC News, 5 June 2004

Reaganomics on Wikipedia, the free encyclopedia

"Reagan changed the world", Paul Craig Roberts, Townhall.com, 7 June 2004

"Reagonomics -- Then, Now, and Forever", Larry Kudlow and Stephen Moore, The Club for Growth, 12 June 2004

Reaganomics, William A. Niskanen, The Concise Encyclopedia of Economics

The Myths of Reaganomics, Murray N. Rothbard, Ludwig von Mises Institute

Supply Tax Cuts and the Truth About the Reagan Economic Record, William A. Niskanen and Stephen Moore, The Cato Institute

The Seven Fat Years and How to Do It Again, Robert Bartley

Reacties

jann_

vrijdag, 7 april, 2006 - 21:20An important part of a suffocating government bureaucracy can be eliminated and this people can be switched to more productive tasks.

Moet dat niet zijn: these people can be switched.

Ik vond de 3 posts zeer interessant. Wanneer een reeks posts over globalisering ? Dat interesseert me ook.

Jan

Mitch

zaterdag, 6 augustus, 2005 - 18:23Ivan is right about Roberts, who seems to have drifted off into the cloud-cuckoo land of the paleo-cons, where Pat Buchanan is despised as a moderate. He has moments of lucidity, though, when he talks about economics.

The original US income tax in 1913 was in fact a flat tax. There were personal exemptions that were high enough that most people paid nothing. The flat tax should not be imposed at all until income reaches a reasonable level for subsistence. Using this method, the average tax rate for the poor is low or nothing, the average tax rate for the rich approaches the limit of the top rate, and the top rate is the marginal rate for all taxpayers. The tax regime is neutral about choices made by citizens, so they are free to make decisions that make the most sense for their own happiness.

The economics are obvious, but the morality should be, too: what is more fair than relieving the poor while letting the workers keep what they earn?

ivan

vrijdag, 29 juli, 2005 - 09:45I see your reading list. Paul Craig Roberts is a guy who thought slave labourers were happy people, and who lately has come to doubt the wisdom of free trade. Not a guy i would trust too much.

Outlaw Mike

vrijdag, 29 juli, 2005 - 01:19Technically, Reaganomics in Belgium could work... with amazing results.

But politically, it is IMPOSSIBLE to implement.

The very notion "Reaganomics" is taboo, also even if leading politicians were in favour of the technique, they would lack the will to fully engage themselves.

Also, the intellectual level of our politicans leaves much to desire. Small wonder in a country where Inge Vervotte can become a Minister.

My sad conclusion is that in Belgium Reaganomics will remain a pipe dream.

Joe

maandag, 18 juli, 2005 - 22:10and what about Freakonomics?

http://www.freako...