Reaganomics, a success story (1)

Ronald Reagan

In this three-part series, we will examine Reaganomics, its critics, and what we can learn from it for today's economic problems. Belgian expert in Reaganomics Willy De Wit will be our guide.

BELGIAN ADMIRATION AND INTEREST FOR REAGANOMICS

Our non-Belgian readers may be surprised that that Belgian prime minister Guy Verhofstadt recently spoke out in favor of Reaganomics in an interview with Flemish weekly Humo. He underlined some of the concepts introduced by Reaganomics, which are taken for granted today.

Verhofstadt (right) with LVB (left), 1998

When I think of Reagan, I'm thinking of Reaganomics and the Laffer curve. (Enthusiastically:) Do you remember: a tax cut could create more revenues! Reagan is dead now, but several of his ideas are now self-evident. The Flemish government lowered the estate and gift taxes. Surprisingly, the government got more income.

Few Belgians have analyzed Reaganomics in such an exhaustive way as retired financial consultant Willy De Wit from Antwerp. Recently, he gave a lecture for “FACS” (Free Association for Civilization Studies), a Flemish libertarian think tank. Loaded with facts and figures, he proved that Reaganomics did deliver results and was a success story.

CRITICS OF REAGAN'S ECONOMIC POLICY

But before summarizing the lecture of Willy De Wit, let us listen to the opponents. Numerous they are and their voices ring loud in the media. In November 2001 Mia Doornaert, a well-known Belgian journalist, wrote: “Ronald Reagan was not a great American President”. In the same leading Flemish newspaper De Standaard, Evita Neefs wrote three days after Reagan's death: "America is losing a sympathetic blockhead. He was not particularly intelligent, but extremely charming". These sentences are typical for the prejudice against Reagan and his economic policy, a policy, that - according to the opponents - made the poor poorer and the rich richer and created a huge budget deficit and a gigantic public debt. Moreover (still in the opinion of the opponents) unemployment could only be reduced by low paid McJobs, or “hamburger jobs” as they are called in Belgium.

Reaganomics is probably the only economic doctrine that made its way into a pop song. In 1985, the British group Simply Red criticized the 'antisocial' policy of Reagan in their song “Money’s Too Tight To Mention” (actually, a cover version of an original American song by the Valentine Brothers from 1982).

I been laid off from work my rent is due

My kids all need brand new shoes

So I went to the bank to see what they could do

They said: son look like bad luck got a hold on you

Money's too tight to mention

I can't get an unemployment extension

Money's too tight to mention

[...]

We're talking about Reaganomics

Oh lord down in the Congress

They're passing all kinds of bills

From down Capitol Hill - we've tried them

Money's too tight to mention

Oh money money money money

Money's too tight to mention

Cutbacks!

[...]

The popular perception of Reaganomics is clear: an antisocial policy with a curtailment of social expenses. But criticizing Reaganomics is not the monopoly of the left. Even classical (i.e. pro free market) liberals and libertarians are convinced that although Reagan stimulated the economy, it came at the cost of an enormous budget deficit.

Even George Herbert Walker Bush was initially very sceptical of the economic ideas of Reagan. In 1980 he spoke about “voodoo economics”. He changed course when Reagan chose him as running mate for the presidency.

WILLY DE WIT: REAGONOMICS SAVED THE ECONOMY

Willy De Wit

THE FUNDAMENTAL FLAW IN KEYNESIAN LOGIC

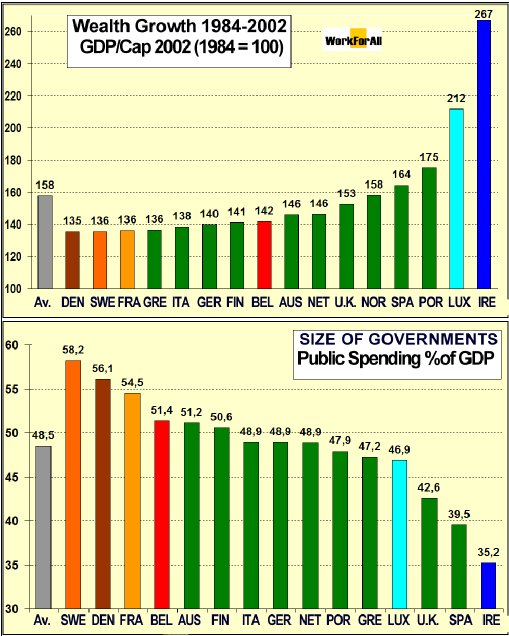

A lot of recent studies indicate that an increase in public spending (as advocated by Keynes) does not stimulate the economy. The main reason is that money that could otherwise be spent efficiently by the private sector, is instead siphoned off for pork-barreling public works, very often with little or no return. Money to pay for deficit spending must come from somewhere else and, as usual, it is the taxpayer who must pay. The fundamental flaw in Keynesian logic is that it hardly makes sense to tax money away from productive people, thereby reducing their rewards, so as to spend it on unproductive goals. Some call it robbing Peter to pay Paul. The United Kingdom, home of Keynesianism, experimented with this medicine for years - only to get sicker and sicker, until Margaret Thatcher stopped it. A more recent example is Japan. This country has provided one of history’s best demonstrations that the Keynesian demand stimulus is a deeply flawed economic philosophy. Despite huge government outlays, the Japanese economy is still wallowing in the slump that has afflicted it for more than ten years. This point of view is confirmed by a recent study (based on multiple regression analysis) from Flemish independent think tank WorkForAll. According to their analysis of the relationship between economic growth and the size of governments in 16 European countries, the two main causes leading to poor growth performance are excessive government spending and a demotivating tax structure, which put a heavy burden on work, income and profit.

Moreover, many influential economists have come to the conclusion that the multiplier effect does not exist. See Paul A. Samuelson (“Economics", edition 1973, page 229), Harvard's Robert J. Barro (“Macroeconomics”, third edition page 301) and “The Wall Street Journal", November 3, 1992 : ( “Keynes is still dead”)

STAGFLATION BECAME RECESSION, EXPANSION FOLLOWED

Four young economists (Paul Craig Roberts, Robert Mundell, Norman Ture and Steve Entin) and a journalist (Jude Wanniski) convinced Reagan to completely reverse the economic policy of that time. Their point of view was that high marginal tax rates were a disincentive to produce, to take risk, to invest and to save. In their opinion this “economy of discouragement” had to be transformed into an “economy of encouragement”. The reasoning was as follows: people are producing because it pays to do so. Consumption alone will not result in increased production when the incentives to do so are not there. When tax rates are raised, people reduce their participation in taxed activities, such as working, risk taking, saving and investing. When tax rates fall, people increase their participation. Fortunately, Reagan understood this logic immediately. Few people know that Reagan had a major in economics, which he obtained at the Eureka College (Illinois) in 1932. The economic theory he was taught was untouched by Keynesian thinking and, as a consequence, very appropriate to the problems of the eighties. Reagan followed the advice and took action. The top marginal tax rate of 70% was lowered in two phases: to 50% with the “ERTA” (Economic Recovery Tax Act of October 1, 1981) and in a later phase to 28% (The Tax Act of 1986). These tax cuts created 18 million new jobs in 8 years, lowered inflation to 4.3% and cut unemployment from 9.7% to 5.4%. One of the longest and strongest economic expansions since World War II had begun, with an average annual growth rate of 3.5%. But the first two years (1981 and 1982) were lost for Reagan. Fed chairman Paul Volcker fought inflation with a tight monetary policy and high interest rates. The Reagan administration urged Volcker to decrease monetary growth by a maximum of 50%, in order not to kill the tax cut program. But as the Federal Reserve is totally independent, Volcker cut money growth by 75% in 1981. The recession became even worse, and unemployment rose further. But after inflation had been defeated, money growth resumed and the Reagan expansion took shape.

In part 2 of this series, we will look at some popular criticism of Reaganomics: the rich got richer and the poor got poorer, employment grew through crappy jobs, and everything came at the cost of a huge public debt. Willy De Wit will prove with figures and facts that these allegations are simply not true.

ADVERTISEMENT

Reacties

DipShitza

maandag, 22 september, 2008 - 18:32Wouldn't it be reasonable to assume that the problem is in the balance of the situation, as both supply and demand side economics would need some form of governmental checks to stop them from going too far into the red? I think the current situation in the US is a perfect example of what happens when regulations are done away with, as Reagan did, but it could just as easily been keynesian theory without regulation leading to an economic bust, which would have taken a much different form. I just don't understand why the economic principles of the so called "developed world" aren't held to the same ideals of common-sense and logical ideas as are most other, much less important aspects of our society.

Martin

vrijdag, 1 april, 2005 - 17:02To the outlaw ,

Hitler did not revive the German economy, on the contrary, he ruined it. The nazi-policies were a fraud from beginning to end. Keynes provided the theoretical pretext for the progressive destruction of the market forces. Hjalmar Schacht provided the monetary tricks to hide temporarely the continuous drop in labor-productivity. In order to get full employment, the bad investments were revived. This means that industry behaves uneconomically toward the very qualified technicians who were already short in supply before the recession. Herman Goering had to shift engineers from one plant to the other and back in a vain attempt to do something against the overheating of the economy. Never before the winter of 1935-1936 was there hunger in Berlin because the rivers were frozen and there was a lack of trains and trucks to provide the capital with food.

Robert Ley of the Deutsche Arbeiter Front stole the money from the social insurance and social security and invented the reverse consumer credit in order to finance the Volkswagen factory which did not produce the cars promised, but build weapons for the war that was to find in other countries the gold, foreign currency and labor which the German economy could not pay.

Demand-side economics may temporarely create full employment, but not the wealth needed to pay the labor force.

Carl Goerdeler - the commissioner of the German Reich for the pricing policy, who in vain tried to curb the inflation and the black market - warned Hitler in 1935 that the German economy had to return to point zero of the depression or face a decline in a pre-industrial age. He did not know that Hitler already planned a war of plunder which would have to establish a new world order with massive slave labor. Hitler sacked Carl Goerdeler. Goerdeler was executed in 1944 for his involvement in the plot to kill Hitler.

In short, you should never start a policy of demand-side economics if you are not prepared to wage a war of conquest.

Barbara

dinsdag, 29 maart, 2005 - 23:00Hey Luc- is it just me or do other people mistake Verhofstadt for Bill Gates? And what is that you're eating? King Ranch casserole? ;)

Barbara

dinsdag, 29 maart, 2005 - 22:56Michael-

You are right to an extent but what you say doesn't conflict with Luc's point. The projects you cite: Hoover Dam, the Autobahnen, and even the interstate highway system in thhe US (built in the 50's) became spurs to economic activity because their existance lowered the cost of goods and services. They are examples of investment, and were highly successful. There are many examples of wasteful projects and spending that is not at all productive, which so much government spending is.

Making them drool? So much more evocative than 'marketing.'

As for people being able to afford the goods, Hayek was looking at the experience of Henry Ford, who said, famously, "I pay my workers enough so that they can afford to buy one of my cars."

Outlaw Mike

dinsdag, 29 maart, 2005 - 22:36Being to a great extent in the trading business myself, I got some firsthand experience of creating economic activity thorugh providing supply. I'd call it: "make them drool". In other words, offer things which are so fancy people can't fight the urge to buy 'em. So i think that Hayek was one smart fella.

On the other hand, one cannot deny that in history Keynesianism seems to have had a degree of success, namely in the thirties in both the US (first under Hoover, then Roosevelts "New Deal") and Hitler reviving the German economy. In the US the Hoover Dam and the Empire State Building, adn in Germany the "Autobahnen" are powerful icons of successful massive government spending. I would say that this is not merely popular wisdom, since afaik both in the US and in Germany the terrible crisis of the late twenties/early thirties came to an end.

It seems to me as Hayeks theorie can work only if people actually have the MEANS to buy the attractive things emerging from the production side. While Keynes's theory would work best in an environment where there is massive poverty.

That is why, imho, Keynesianism was a fairly good means in a time when poverty was ubiquitous (early thirties) while Hayekianism was best suited for the seventies, when, despite a massive unemployment, people STILL had buying power.

Hey, I just want to say that Keynesianism, while totally unappropriate in a basically "rich" society, once may have had its merits.